China Evergrande Crash / Tt Hi7pbibom

Die Evergrande-Pleite wirkt auf China wie ein Fanal. Bis zum gigantischem Crash in China der unweigerlich kommen wird wenn die Bürger ihren Teil am Aufschwung einfordern werden.

Investors are worried that Evergrandes unraveling will ensnare the property sector and the commodities that feed it.

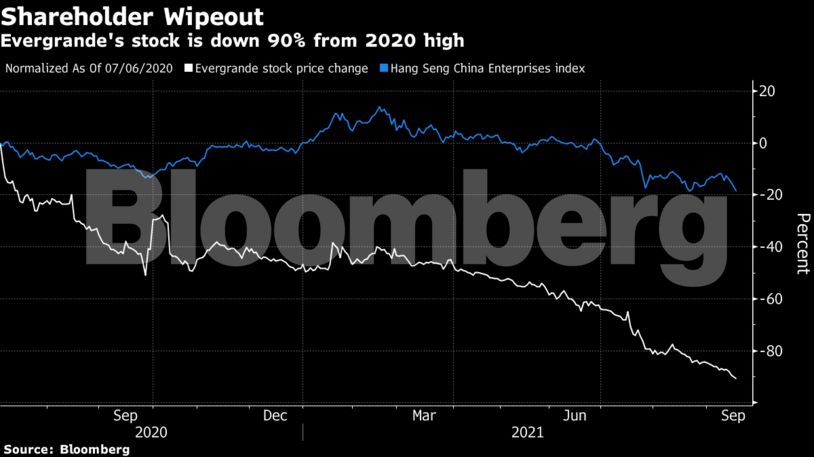

China evergrande crash. China Needs a Lehman-Level Meltdown to Crash Its Steel Mills. While Evergrande is less of a whale onshore a collapse could force banks to cut their holdings of corporate notes and even freeze money markets -- the very plumbing of Chinas financial system. Embattled Chinese property giant Evergrande on Wednesday suffered a second credit rating downgrade in two days raising fears the worlds most indebted company will default and sending its shares tumbling below their listing price 12 years ago.

Evergrande has nearly 800 projects across China that are unfinished and as many as 12 million people who are still waiting to move into their new homes according to research from REDD Intelligence. The distress surrounding Evergrandes crash is a window into the problem of bad debt in Chinas housing sector. Evergrande Chinas second-largest property developer may be on the brink of collapse.

Zeng said a sizable number of developers in the offshore dollar market appear to. But experts say the Chinese Communist. Evergrande is close to default the question is whether this causes a recession in China and ripples across financial markets.

The once-mighty Evergrande Group has long been the face of Chinese real estate surfing a decades-long property boom to expand into more than 280 Chinese cities as it. China Evergrande Group shares slumped to a fresh 11-year low in Hong Kong trading Monday as the indebted property developer scrambles to find cash ahead of around 150 million in bond coupon. Das Schreckgespenst einer neuen Finanzkrise geht um.

Ein Börsen-Gigant mit 200000 Angestellten und von dem 38 Millionen Jobs in China abhängen. Evergrande collapse could have a domino effect on Chinas property sector AllianceBernstein says A spillover of the crisis at China Evergrande Group into other parts of the economy could become a systemic problem. Der zweitgrösste Immo.

Founded by former Chinese steel executive Xu Jiayin in. The firms issues sparked a global stock selloff as investors feared history was repeating itself. With algos busy chasing upward momentum in futures and global stocks the biggest if largely ignored story remain the ongoing collapse of Chinas Lehman the 300 billion China Evergrande where following our earlier reports see below that a bank run emerged among creditors of the biggest and most indebted Chinese developer as its bonds were no longer eligible collateral in.

Investors are bracing for the increasing risk that Chinese real estate colossus Evergrande will collapse under the weight of more than 300 billion of debt. While Evergrande is less of a whale onshore a collapse could force banks to cut their holdings of corporate notes and even freeze money markets -- the very plumbing of Chinas financial system. If history is.

In such a credit crunch the government or central bank would likely be forced to act. Evergrande Real Estate or Heng Da Group in Chinese owns more than 1300 building projects in more than 280 cities across China. In a nutshell Evergrandes collapse would be the biggest test that Chinas financial system has faced in years CNBC reported Mark Williams chief Asia economist at Capital Economics.

Evergrande S Collapse Would Have Profound Consequences For China S Economy

China S Nightmare Evergrande Scenario Is An Uncontrolled Crash Bloomberg

Evergrande Why The Chinese Property Giant Is Close To Collapse Business Economy And Finance News From A German Perspective Dw 16 09 2021

Evergrande S Crisis Does Not Pose Systemic Risk Won T Change Housing Regulations Experts Global Times

Why Evergrande S Debt Problems Threaten China The New York Times

Why Evergrande S Debt Problems Threaten China The New York Times